how much is inheritance tax in nc

These are some of the taxes you may have to think about as an heir. There is no inheritance tax in NC.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

After Aunt Ruths estate deducts the exemption she would only owe gift and estate taxes on the remaining 155 million taxed at the rate of 40 percent.

. North Carolinas estate tax was ultimately repealed in July 2013. If you live in a state that does have an estate tax you may be expected to pay the death tax on the money you inherit from a death in NC. Each has its own laws dictating who is exempt from the tax who will have to pay it and how much theyll have to pay.

North Carolina Inheritance Tax and Gift Tax. 5 rows How Much Tax Do You Pay On Inheritance In Nc. A surviving spouse is the only person exempt from paying this tax.

There is no inheritance tax in North Carolina. Inheritance taxes are paid by beneficiaries of an inheritance on the amount they receive. However there are sometimes taxes for other reasons.

Charitable and nonprofit organizations dont pay a tax if the amount is less than 500 but 10 percent of anything over the amount. North Carolina Inheritance Tax and Gift Tax There is no inheritance tax in North Carolina. However there are sometimes taxes for other reasons.

How much inheritance is tax free in NC. No Inheritance Tax in NC There is no inheritance tax in NC so if you give 18000 to your niece at your death you dont need to worry about your estate or her paying taxes on it. North Carolina does not collect an inheritance tax or an estate tax.

North Carolina does not collect an inheritance tax or an estate tax. In 2021 federal estate tax generally applies to assets over 117 million. For example lets say a family member passes away in an area with a 5 estate tax and a 10 inheritance.

How much tax do I pay in NC on inheritance of 33000 thirty three thousand dollars. States that collect an inheritance tax as of 2019 are Iowa Kentucky Maryland Nebraska New Jersey and Pennsylvania. It can be less if the court determines to set it lower.

If you inherit property in Kentucky for example that states. However this is five percent of the value after all debts have been paid. The federal estate tax exemption is 1158 million in 2020 so only estates larger than that amount will owe federal estate taxes.

Bank accounts certificates of deposit and investment. Technically North Carolina residents dont pay the inheritance tax or estate tax when they inherit an estate within the state. States With an Inheritance Tax.

Inheritance taxes are levied on heirs after they have received money from the deceased. However state residents should remember to take into account the federal estate tax if. How much inheritance is tax free in NC.

However now that North Carolina has eliminated its estate tax most wealthy North Carolina residents will owe estate taxes only to the federal government. Even though North Carolina does not collect an inheritance tax however you could end up paying inheritance tax to another state. Initiatives were floated to repeal Nebraskas inheritance tax and North Carolinas estate tax in 2012 but nothing happened on this front in Nebraska.

If the estate exceeds the federal estate exemption limit of 1206 million it becomes a subject for the federal estate tax with a progressive rate of up to 40. According to the law an executor can receive up to five percent of the value of the estate for compensation. For the year 2016 the lifetime exemption amount is 545 million.

Distant family and unrelated heirs pay between 10 and 15 percent of the value of the inheritance. The North Carolina estate tax does not. There is no guarantee of five percent in the law.

Items included in the deceased persons taxable estate include real estate vehicles and the proceeds from life insurance policies explains Nolo. The inheritance tax rate in North Carolina is 16 percent at the most according to Nolo. Iowa Extended family pays a 5 percent tax on the first 12500 of the inheritance and up to 10 percent of estates worth over 150000.

You might inherit 100000 but you would pay an inheritance tax on only 50000 if the state only imposes the tax on inheritances over 50000. However state residents should remember to take into account the federal estate tax if their estate or the estate they are inheriting is worth more than 1118 million. Iowa for instance doesnt impose an inheritance tax on beneficiaries of estates valued at 25000 or less.

Maryland imposes both an estate tax and an inheritance tax. North Carolina does not collect an inheritance tax or an estate tax. However state residents should remember to take into account the federal estate tax if their estate or the estate they are inheriting is worth more than 1206 million.

No Inheritance Tax in NC. The inheritance tax of another state may come into play for those living in North Carolina who inherit money. If you inherit from somone who lived in one of the few states that has an inheritance tax--Iowa Kentucky Nebraska New Jersey Pennsylvannia and Maryland --you may get a tax bill from that state.

- Answered by a verified Tax Professional We use cookies to give you the best possible experience on our website. The inheritance tax of another state may come into play for. There is no federal inheritance tax but there is a federal estate tax.

On November 6 2012 Ballot Measure 84 which would have repealed Oregons estate tax by January 1 2016 was defeated by a. However there are 2 important exceptions to this rule.

Guide To Nc Inheritance And Estate Tax Laws Hopler Wilms Hanna

North Carolina Estate Tax Everything You Need To Know Smartasset

North Carolina Estate Tax Everything You Need To Know Smartasset

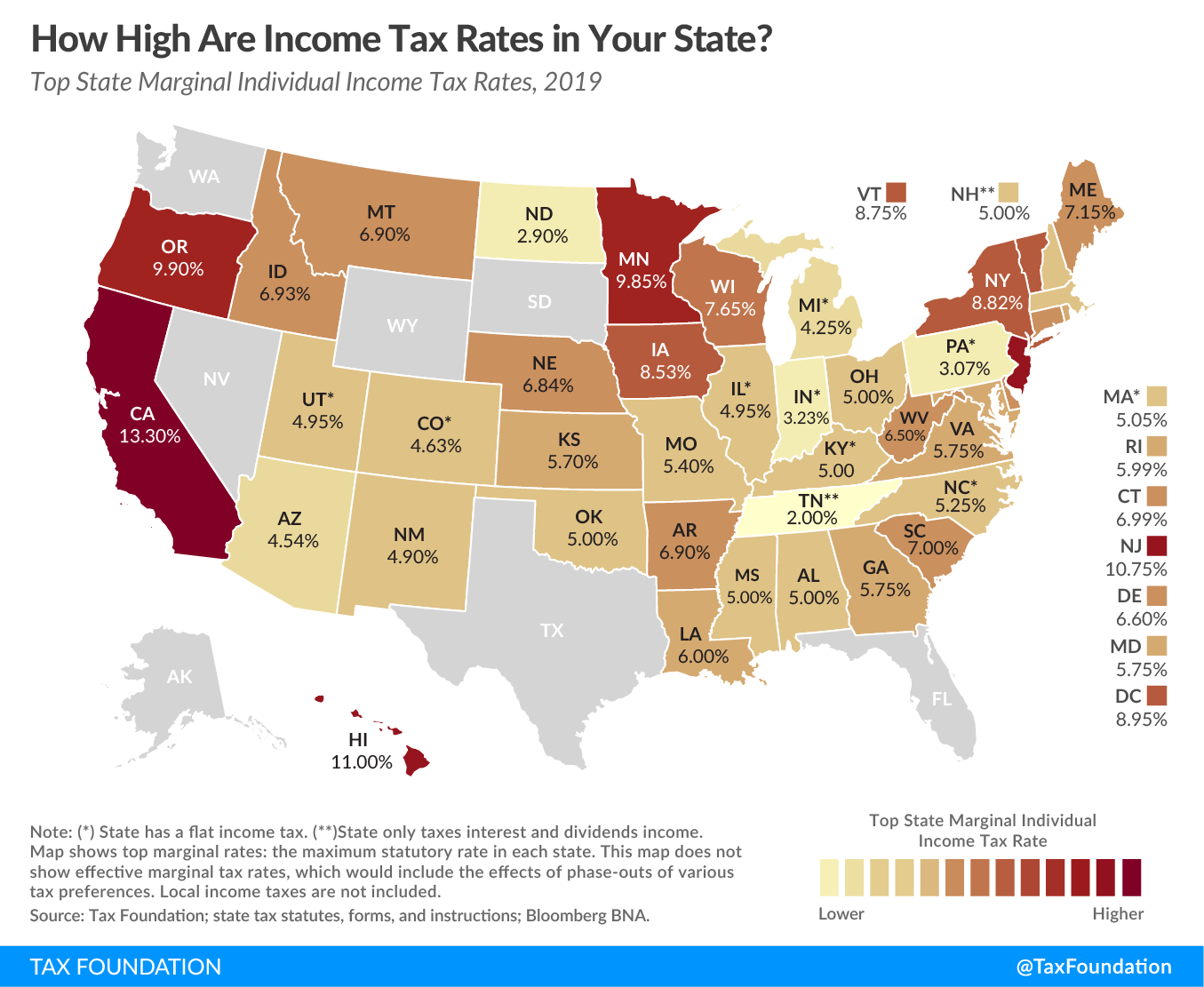

North Carolina State Taxes 2022 Tax Season Forbes Advisor

States With Highest And Lowest Sales Tax Rates

Calculating Inheritance Tax Laws Com

Historical North Carolina Tax Policy Information Ballotpedia

Worst States For Retirement For 2018 New Tax Law Takes Its Toll Topretirements

States With No Estate Tax Or Inheritance Tax Plan Where You Die

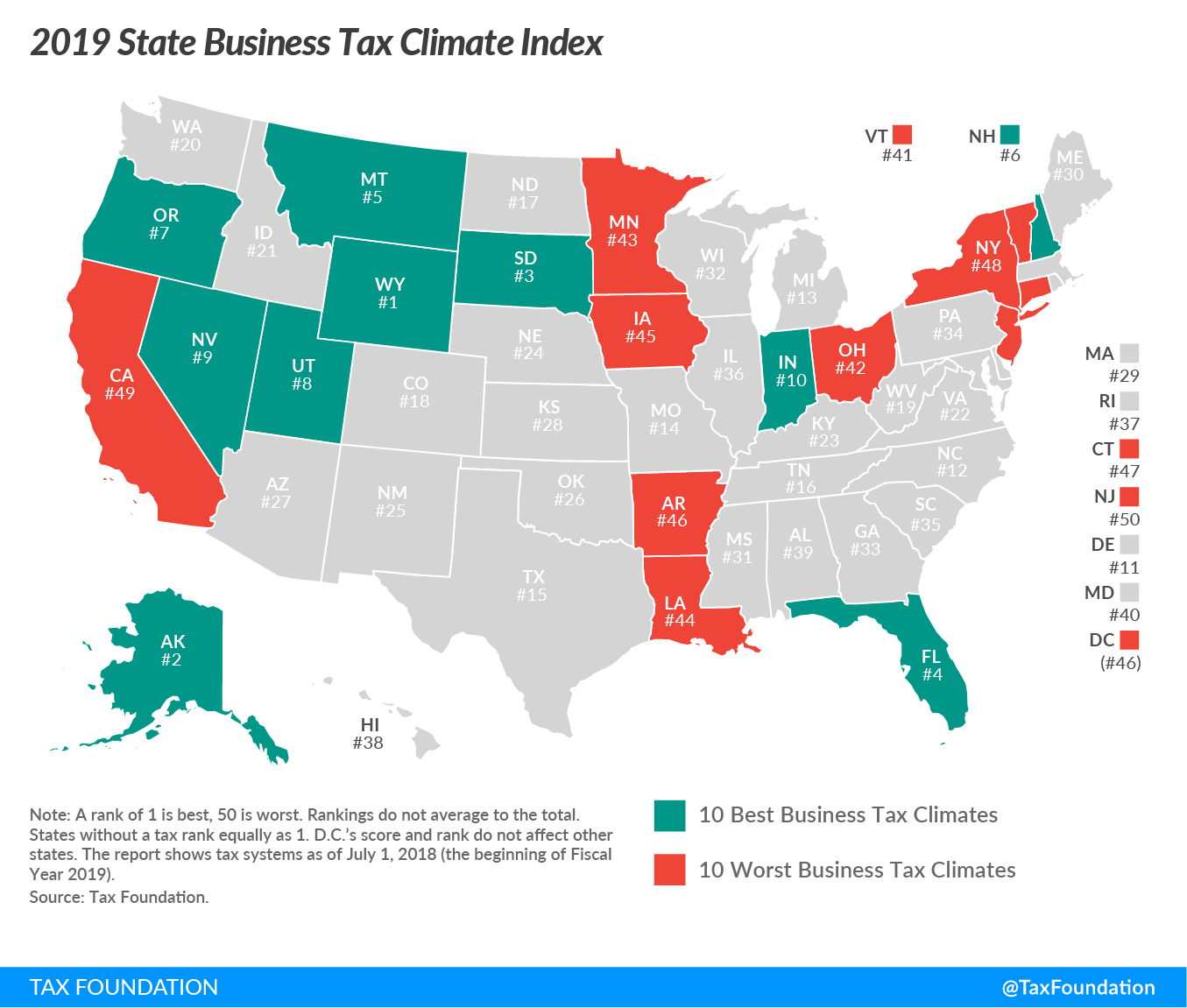

North Carolina Ranks Third Nationwide In Competitive Corporate Income Taxes Economic Development Partnership Of North Carolina

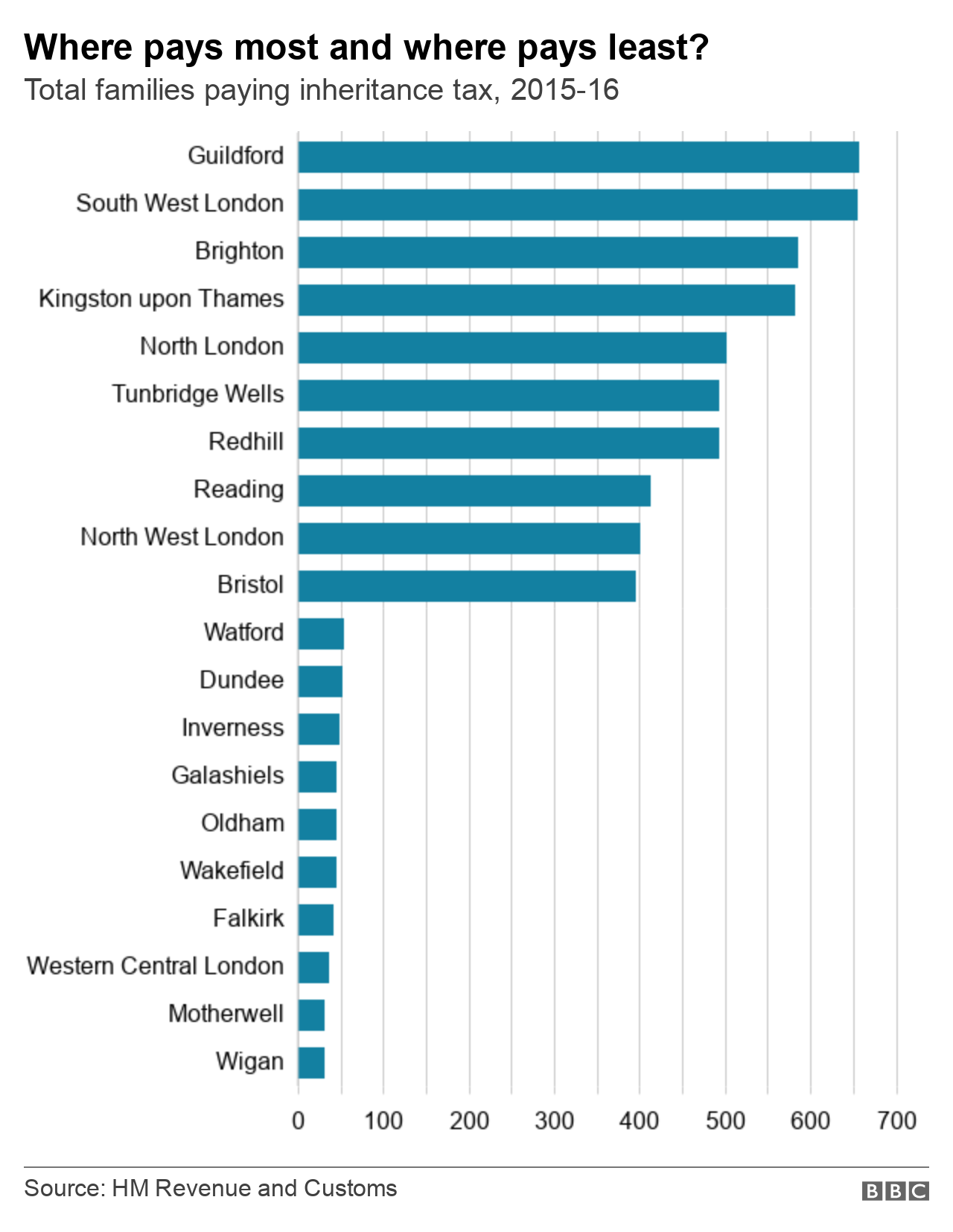

Guildford Is The Inheritance Tax Capital Of The Uk Bbc News

Us State Tax Planning Gfm Asset Management

Guide To Nc Inheritance And Estate Tax Laws Hopler Wilms Hanna

North Carolina Ranks Third Nationwide In Competitive Corporate Income Taxes Economic Development Partnership Of North Carolina

North Carolina Estate Tax Everything You Need To Know Smartasset

North Carolina Estate Tax Planning Law Brady Cobin Law Group Pllc

Is There An Inheritance Tax In Nc An In Depth Inheritance Q A

How Can I Mitigate My Children Paying Taxes On My Estate In Raleigh When I M Gone